capital gains tax canada inheritance

If the home was. A 2014 survey by BMO InvestorLine found that Canadians expected an average inheritance of just over 96000.

German Tax Advice For Smart Foreign Real Estate Investors Owners

There is no estate tax or inheritance tax in Canada.

. Because Johns parents would have paid any capital gains up to the time of him inheriting the cottage his estate is required to pay a 50 capital gain on 150000 500000. You will have to report a capital gain on your Canadian tax return half of which is taxable. How Do I Figure Out the Capital Gains Tax Rates on Inheriting Real Estate in Canada.

Non-registered capital assets are. For example in Ontario there is no fee on small estates. When a person dies in Canada taxes are owed too.

However taxation may occur during the process of transferring and distributing an estate or inheritance. Tax on Inherited Property Keeping Records Can Prevent Surprises Later. If a deceased person has invested in stocks valued at 100000 at the time of death and the adjusted cost base of the investment is calculated as 80000 then a capital gains tax.

The dead are said to have received the. At the time you receive your. When you inherit property the IRS applies what is known as a stepped-up cost basis.

Sell the house shortly after you inherit and youll find the capital gains tax will be nominal as there will be little difference between the assessed fair market value that was done. Capital gains tax by adding to the increase in value as a result of being inherited. However every province except Quebec and Alberta has a probate fee.

So if someone owns two properties at once like a house and a cottage one property will generally be subject to capital gains tax. You do not automatically pay taxes on any property that you inherit. Generally when you inherit property the propertys cost to you is equal to the deemed proceeds of disposition for the deceased.

If the property that you are inheriting was the principal residence of the deceased then you would not pay any inheritance. There is no inheritance tax on property in Canada. Averages did however differ greatly across the country.

As a general rule inherited property is non-taxable in Canada. Usually this amount is the FMV of the. Non-registered capital assets are considered to have been sold for fair market value immediately prior to death.

Donations of cultural property made on or after March 19 2019 no longer require that property be of national importance to claim the exemption from income tax for any capital gains arising. If you decide to sell an inherited property then you will only have to pay capital gains tax. That means the fair market value of the home at death gets used to calculate capital gains tax rather than the amount the decedent originally bought the home for.

What are Canadas inheritance tax rates. Namely the estate includes all your assets such as your home investments savings and personal. Regardless of whether or not you plan.

As indicated there is no estate tax in Canada. If you think you may be. Assuming Eric your mother has not.

As there is no inheritance tax in Canada all income earned by the deceased is taxed on a final return. The top rate for capital gains tax may increase from 29 to 49 percent state and federal rates combined How to Avoid Capital Gains Tax on Inherited Property. Any resulting capital gains are 50 taxable and added to all other income of the.

The gain is equal to the difference between the market value of the property on the. The inheritance tax is a tax that is charged on the value of your estate when you die. Get An Appraisal Save Any Older Records.

When an asset passes to a surviving spouse on death by default it is transferred at its adjusted cost base for tax purposes meaning no capital gains tax is payable at that time. If you sell you owe capital. In Canada there is no inheritance tax or death tax so there is no need to pay it.

Germany Tax Information Income Taxes In Germany Tax Foundation

Understanding Capital Gains Tax When You Inherit Scott Partners

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Foto De Stock Hombre De Firmar El Pasado Y Testamento End Of Life Last Will And Testament Washington National

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Germany Tax Information Income Taxes In Germany Tax Foundation

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Canada Capital Gains Tax Calculator 2021 Nesto Ca

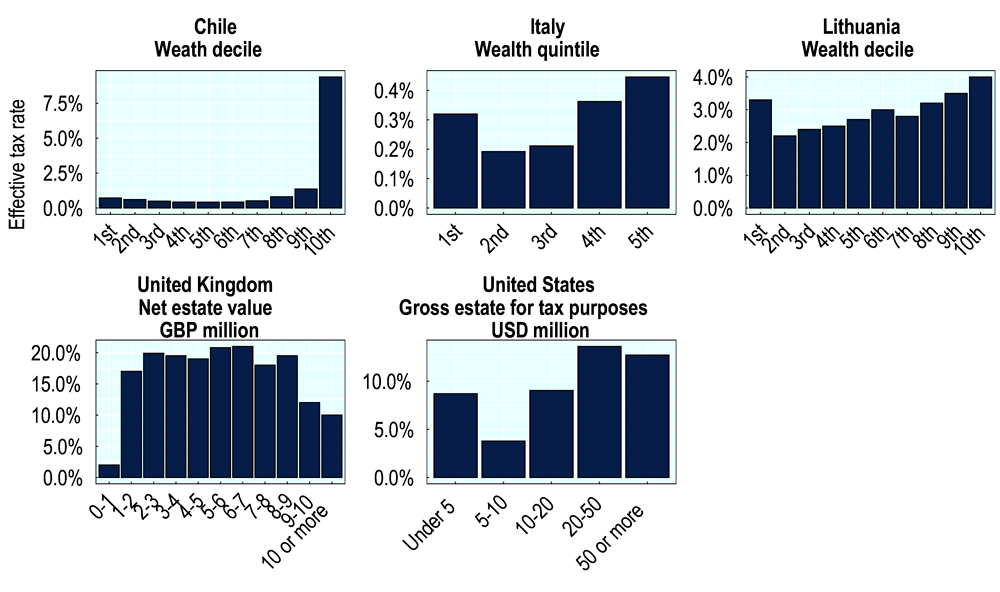

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

Is There Capital Gains Tax On Inherited Property In Canada Ictsd Org